You lower the electricity costs of your community to zero as a committee member. Although it might seem unthinkable, it is not impossible. To meet your society’s energy needs, you just need to switch to a cleaner, more sustainable source.

Like yours, many housing societies frequently struggle with excessive electricity prices that raise maintenance costs, upsetting tenants. The good news is that housing societies are making the brave decision to use solar energy, and the outcomes are remarkable!

Solar adoption is turning into a profitable and wise decision thanks to government subsidies like the PM Surya Ghar Muft Bijli Yojana. As a result, housing societies can improve their energy needs and help create a more sustainable future.

If you are a committee or RWA member and you’re thinking about going solar, this article covers–

- A few crucial things to think about before your community goes solar

- The approximate solar cost for a Management Committee or RWA

- The financial options that are accessible

- How to pick your housing society’s best solar solution from the top solar vendor

Considerations for Solar's Cost in Housing Societies

1. Use of Electricity

The viability and size of the necessary solar system are determined by assessing the society’s electricity usage. To determine how much solar energy could balance energy demand peaks, compile electricity bills from the previous year.

For instance, if you need 1,40,000 units of electricity year on average, the amount of solar system you would need is

~1400 units for 1 kW of solar

Size of solar system = power used/units produced per kW = 1,40,000/1,400 = 100 kW

2. Unobstructed Roof Area

There should be enough clear space on your roof for the solar panels without any shadows cast on them. To maximum solar exposure, the system should ideally be orientated with its face towards the south and at a 10° inclination. Make sure that nothing will cast shadows on the panels, such as trees, nearby structures, TV dishes, or other objects.

A 1kW solar usually requires about 80 square feet of roof area. A 100 kW solar system requires roughly 8,000 square feet.

3. Authorised Load

The maximum quantity of electricity that a housing society is permitted to take from the grid, as established by the electricity board, is known as the sanctioned load. Check your authorised load and make sure the size of your solar panel installation doesn’t go over this authorised limit.

Consider asking the power board for an increase if the planned solar panel installation exceeds the approved load.

The Solar System's Price Range for Housing Societies

The capacity needed to meet your society’s energy needs determines how much a solar system will cost. Additionally, it differs according on the brand and kind of solar panels selected. One thing, meanwhile, never changes: the subsidy is fixed at ₹18,000 per kW (up to ₹90 Lac) throughout India.

To further understand the charges, let’s examine an example:

The project’s DC capacity is 100 kW.

185 panels are needed, and each one costs between ₹45,000 and ₹65,000.

*100 kW / 0.54 (the wattage capacity per module for MonoPERC half-cut bifacial panels) is the formula for a 100 kW system with Mono-PERC bifacial solar panels.

Cost of the Project (No Subsidy):

Using a mean of 60,000 kilowatts per kW:

60,000 * 100 kW = 60,000,000

₹18,000 per kW * 100 kW = ₹18,00,000 is the subsidy.

After the subsidy, the total project cost is ₹60,00,000 minus ₹18,00,000, or ₹42,00,000.

This is a ballpark figure to give you an idea of what to anticipate while organizing the solar transition in your community.

The brand/type of panel and other factors selected may affect the final cost, but the financial and ecological advantages are obvious!

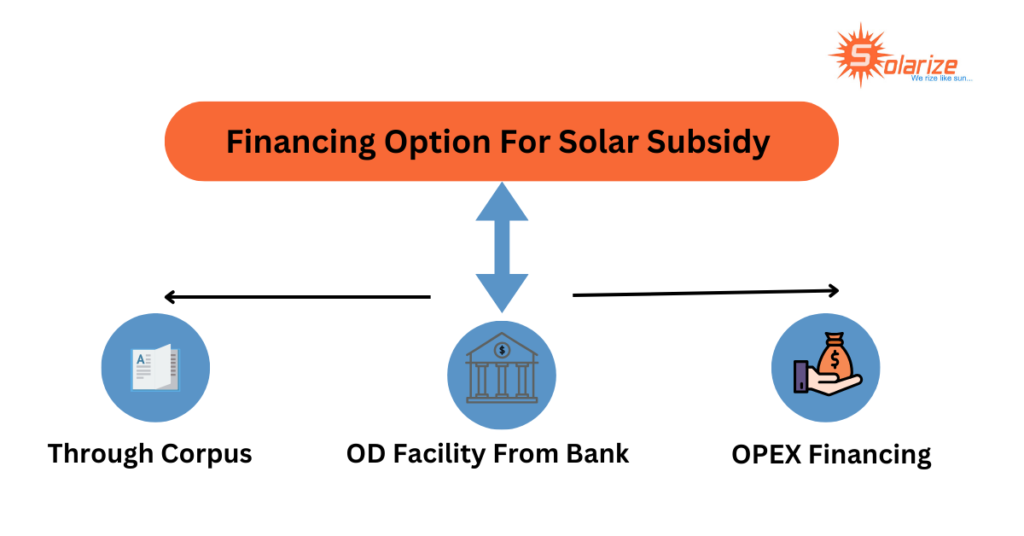

Options for Housing Societies to Finance

For a variety of reasons, housing societies frequently have serious concerns about financing. Thankfully, a number of adaptable and reasonably priced financing options are available to help increase accessibility to the solar transition without placing a burden on the Society’s finances.

1. Through Corpus

The need for external loans can be avoided if the community has a sizable reserve that it can allocate to the solar project. Over time, the fund will be restored in part by the decline in electricity costs. Society can still handle maintenance and emergency demands without depleting its reserve reserves if intelligent budgeting and resource allocation are practiced.

2. Through OD Facility from the Bank

If the society has a solid relationship with the bank and can provide an overdraft loan at a cheaper interest rate, the OD facility is an excellent alternative. Generally speaking, banks need a solid project proposal, financial records, and a solid credit history. The bank and the society will need to talk about things like interest rates and the overdraft limit.

3. Financed by OPEX

With this kind of financing, solar energy can be accessed without requiring a sizable upfront payment. The solar system on your roof will be designed, built, engineered, purchased, monitored, maintained, and owned by your preferred solar provider.

Signing a Power Purchase Agreement (PPA) entails paying the solar system vendor a monthly electricity bill, which is frequently less expensive than the standard DISCOM prices per unit.

4. Through 0 Investment Plan with PV Solarize

Our Zero Investment Plan makes switching to solar energy with PV Solarize easy and reasonably priced.

This is how it operates:

Zero Initial Investment: You begin with no out-of-pocket expenses since the government subsidy reimburses the down payment you make.

Easy EMIs: You are virtually paying nothing more because your monthly EMIs are calculated to reflect the savings on your electricity bill.

Flexible Payment Terms: You can choose an EMI plan that suits your budget with our flexible options, which range from 6 to 60 months.

Our plan will start saving you money right away, making your solar investment all but free. It’s the easy and intelligent way to switch to solar power!

Selecting the Appropriate Solar for Your Community

For a seamless installation procedure and long-term satisfaction, consider these aspects when selecting a solar provider for your housing society.

1.Assess Their Level of Experience

- View the business’s Previous installations.

Take a look at the places where the company has already installed solar systems, preferably ones that are about the same size as your housing society. What is the performance of the installations? How do they fit into the current configuration, and what is their general state?

Speak with management or tenants to learn firsthand about their experiences.

- Check customer reviews

To gauge consumer happiness, look at reviews on Google, social media, and other review platforms. Request case studies or testimonies from the business that highlight successful initiatives and comments from those members of the community.

- Examine their background in managing housing society initiatives.

What is the number of housing society projects that the company has completed successfully? Examine their team’s technical credentials; seek for appropriate certifications, training, and experience with complex installations.

2.Look for a solar partner with the necessary maintenance and after-sales skills

The lifespan of your housing society’s solar system is extended and kept operating properly with routine maintenance. Your solar system needs regular maintenance to prevent expensive problems, just like your autos and air conditioners do.

Without adequate maintenance, you run the danger of experiencing unplanned malfunctions, decreased productivity, and sharp declines in energy output—problems that have the potential to upend society as a whole and raise costs.

Select a vendor who offers timely support to limit downtime, handle issues promptly, and guarantee uninterrupted energy generation in order to safeguard your investment.

Looking For:

All-inclusive coverage: The maintenance service ought to include routine cleaning, repairs, inspections, and system performance monitoring.

Response time: Verify that the service agreement specifies how long it should take to resolve issues.

Guarantees and warranties: Examine the solar panels’ warranty terms and the calibre of the installation.

3. Verify that their structures are resistant to cyclones.

Were the mounting solutions designed to withstand extreme weather conditions such as storms, heavy rain, and strong winds? Are the parts strong enough to withstand corrosion and last a long time? Check to make sure the structures meet all relevant national and international durability and safety requirements.

This is an illustration of a solar installation that was not designed to survive extreme weather.

4. Examine the Solar Partner's terms of payment and financial stability.

Verify the company’s financial stability to make sure it can finish the project and continue to support it. Look for signs of stability, such as a strong industry record and favourable comments from clients and suppliers.

Clearly state the terms of payment, including the first installments, milestones, and the ultimate settlement. Verify whether the business provides flexible payment choices like financing plans or installments that are contingent on the completion of the project.

5. Request a Comprehensive Quote

The following are essential components of a quote from the best solar supplier:

System design: Detailed design information that outlines the type and number of panels, inverters, and other components that are required.

Breakdown of costs: a detailed explanation of the costs associated with installing solar panels, including equipment, setup, upkeep, and extra charges.

Timeline: A schedule that details the length of the project, from installation to commissioning.

Guarantees and warranties: Information about the panels’, inverters’, and installation work warranties.

Obtain several quotes and evaluate them according to terms, quality, services provided, and the cost of installing solar panels. Think at the value as a whole, not just the lowest cost. The highest long-term value might not always come from the least expensive choice.

FAQ'S

Q1. When will the housing society get the solar subsidy?

Ans. The timeline for receiving this subsidy varies, depending on the approval process by the government authorities and their disbursal cycle. You can check the subsidy status through the national portal for rooftop solar.

Q2. How can the housing society apply for solar financing with PV Solarize ?

Ans.

The eligibility criteria for PV Solarize financing include the following:

| Profitability of the Society | Revenue should be positive |

| Maintenance Collection | 90% must be collected on Time |

| Capital + Reserves | Must be 10% of Loan Value |

| Power Bill Repayments | No dues |

| Right to Roof | To be present for solar installation. |

| Provision of borrowing in bye-laws | Should be available |

| Duration of present Society’s management committee and next election date | Minimum till loan tenure. |

| Any existing major loan from the Bank | Yes/No |

Documents required include the following:

- PAN CARD of society – Self-attested

- KYC of signing authority (Any 2 Members) – Self-attested

- Registration documents – Self-attested

- List of members – Self-attested

- Contact details of signing authority

- Last 12 months’ bank statement

- The last 3 months’ electricity bill

- The last 2 years audited financials

- Quotation

Loan approvals are fast, often within 2-3 days. EMIs commence after the loan is approved.

Q3. When will the breakeven point happen for housing societies?

Ans. The breakeven point for housing societies investing in solar energy depends on the price per unit charged by the electricity board.

Formula:

Breakeven Point (years) = Net Cost of Solar Project/Annual Savings

Where:

- Net Cost of Solar Project = The total cost after subsidy.

- Annual Savings = Annual Energy Production (in units) × Rate per Unit of Electricity

Example Calculation:

For a 100 kW system with an average cost of ₹60,000 per kW:

- Net Cost of Solar Project = ₹60,00,000 – ₹18,00,000 = ₹42,00,000

- Rate per Unit of Electricity = ₹10 per unit

- Annual Energy Production = (from the previous example, 100 kW system) ≈100×1400=1,40,000 units/year

Steps:

- Calculate Annual Savings:

Annual Savings = 1,40,000×10 = ₹14,00,000 - Calculate Breakeven Point:

Breakeven Point (years) = 60,00,000 / 14,00,000 ≈ 4.2 years

This means the housing society would recover the solar installation cost in about 4.2 years from saving on electricity bills.

Q4. What is the maximum subsidy a housing society can avail itself of through PM Surya Ghar Muft Bijli Yojana?

Ans. Housing societies can receive a government subsidy of ₹18,000 per kilowatt, up to ₹90 lakh for a maximum of 500 kilowatts.

Q5. Is solar maintenance necessary for housing societies?

Ans. Yes, solar maintenance is necessary to ensure optimal performance of the solar power systems. Over time, panels can accumulate dust, debris, bird droppings and other residues that can significantly decrease their effectiveness.

Scheduled maintenance with cleaning and inspections can prevent these issues, prolong the solar system’s lifespan, and ensure that the system continues to provide substantial energy savings for society.